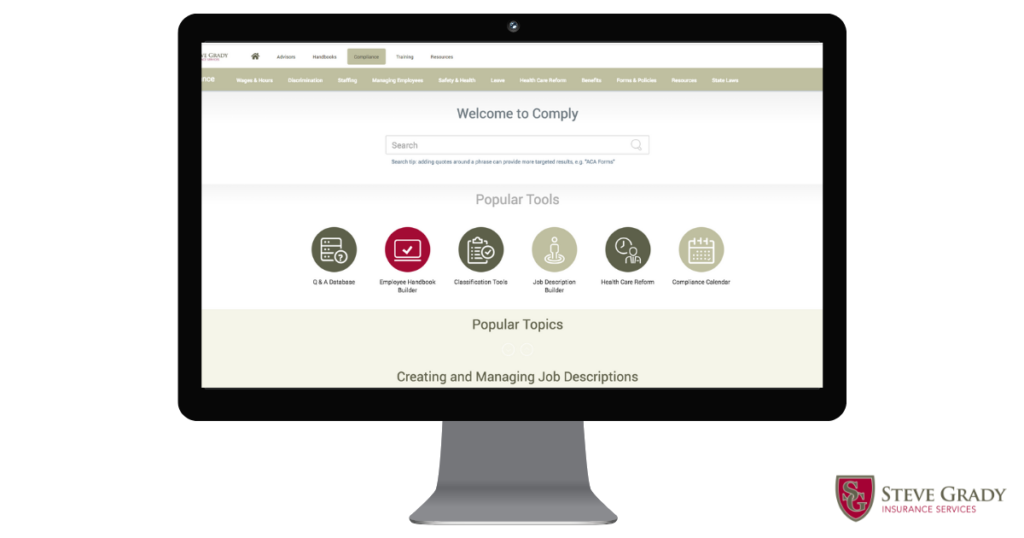

Introduction to ThinkHR: This is Part 3 of a series of blog posts we’ll be sharing on our preferred HR technology platform, ThinkHR. You can read Part 1: How Think HR Can Help Reduce Your Business Expenses here and Part 2: How ThinkHR Can help Your Business Create an Employee Handbook here. In this post, we’ll be discussing ThinkHR’s unique Compliance tool. There are new laws and updates constantly, and it is vital to make sure your company is up-to-date with any new compliance acts. This tool includes useful features, such as: a Q&A Database, Employee Handbook Builder, Classification Tools, Job Description Builder, Health Care Reform, and a Compliance Calendar.

Q&A Database:

The Q&A Database answers over hundreds of human resources, payroll, and benefits questions very quickly by expert advisors. To ask a question, you simply type in the question you want to ask, and then choose the category it falls under in the drop-down menu to the right. This feature also lists recent Q&A that have been asked along with answers, and many times the answer to your question is already listed.

Employee Handbook Builder

Having an employee handbook is essential for your business; therefore ThinkHR makes this easy for you by walking you through each step. The previous blog post in December goes into more detail regarding this tool.

Classification Tools

This tool helps to ensure you accurately identify on whether your worker is an independent contractor or employee for federal tax or wage and hour purposes. There is also a tool that helps you identify if the worker is a FLSA white collar worker. By making sure you know the correct classification of your employee, it can help you avoid future fines later.

Job Description Builder

Job descriptions can help you minimize employee-related liability in the future; therefore ThinkHR has a tool to walk you through building a job description. To assist you later if you get in a disability discrimination, you should have an accurate and thorough job description because it can help hold up your end in court. This also helps your employees better understand the responsibilities and expectations of the job prior to obtaining it.

Health Care Reform

This section under the Compliance tab goes over, in detail, about health plan requirements, employer requirements, fees/taxes, general information, and ACA reporting forms. It also supplies you with small and large employer health reform checklists to audit where your company currently stands regarding health care. It also allows you to click on the state in which your business resides in to make sure you receive the more specific information on health care reform for your state.

Compliance Calendar

This calendar contains all important dates and deadlines for forms, key dates, and deadlines to ensure you never have to miss a deadline again. It’s all in one calendar to ensure your convenience.

Is this a tool you might be interested in? Call (619) 222-0119 where we can help assist you with any questions you may have about the process.