Creative Benefit Solutions Employers Are Offering

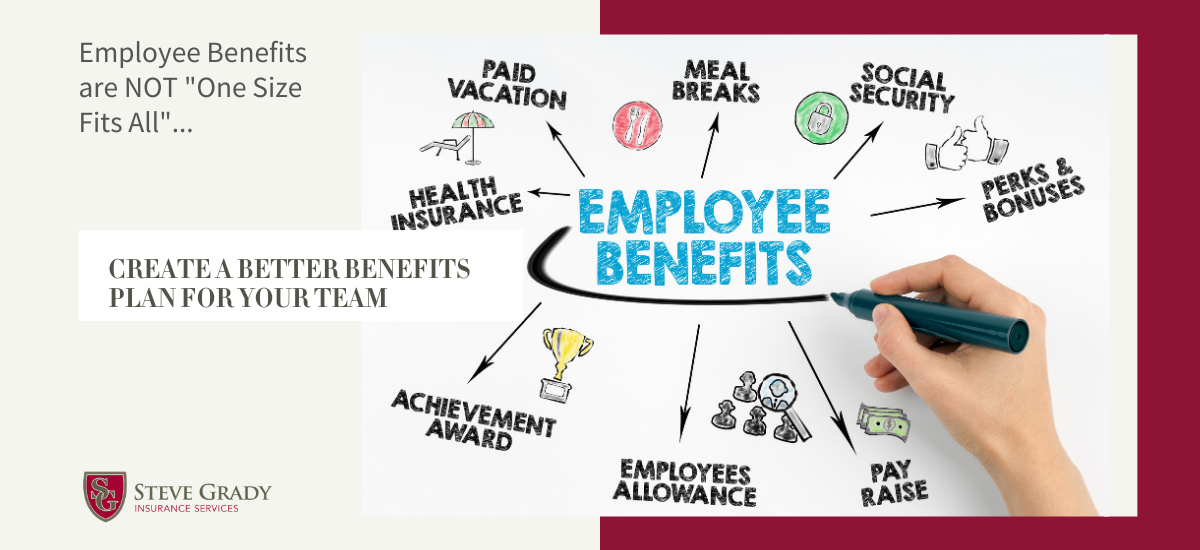

Creating an Employee Benefits package that satisfies everyone’s wants, needs and budget can be challenging.

Creating an Employee Benefits package that satisfies everyone’s wants, needs and budget can be challenging.

Health insurance plans provide a number of preventive services that many employees don’t know are

Any good employer knows the importance of having a competitive benefits package to offer their

Change can be a scary thing, but it doesn’t have to be! Especially when it

Do you want to retain employees and recruit better talent at little to no cost

It’s that time of year again— time for HR to prep for a successful open

Employee benefits is a wide-ranging topic that can boost engagement, productivity and your business’ bottom

A health insurance provider network is a list of doctors, health care providers, and hospitals

Managers often find disciplining employees and making termination decisions challenging. Most HR professionals must deal

Small business owners mistakenly believe they either cannot afford to offer benefits to their employees