Creative Benefit Solutions Employers Are Offering

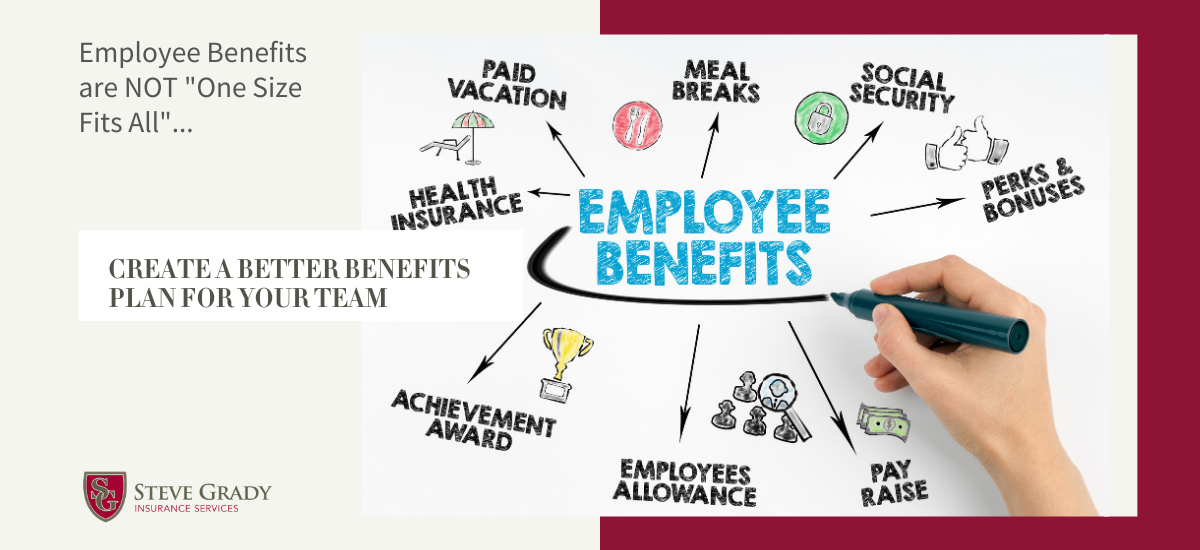

Creating an Employee Benefits package that satisfies everyone’s wants, needs and budget can be challenging.

Creating an Employee Benefits package that satisfies everyone’s wants, needs and budget can be challenging.

If you’ve recently left jobs or lost health coverage, you may have had someone mention

Any good employer knows the importance of having a competitive benefits package to offer their

Many employers feel like leave of absence (LOA) abuse is difficult to stop because there

Do you want to retain employees and recruit better talent at little to no cost

It’s that time of year again— time for HR to prep for a successful open

Employee benefits is a wide-ranging topic that can boost engagement, productivity and your business’ bottom

Small business owners mistakenly believe they either cannot afford to offer benefits to their employees

A key to success in any business is great communication between an employer and its

It’s good to have choices when it comes to health insurance that way you can